Questions

FINS5530-Financial Institution Mgmt - T3 2025

Single choice

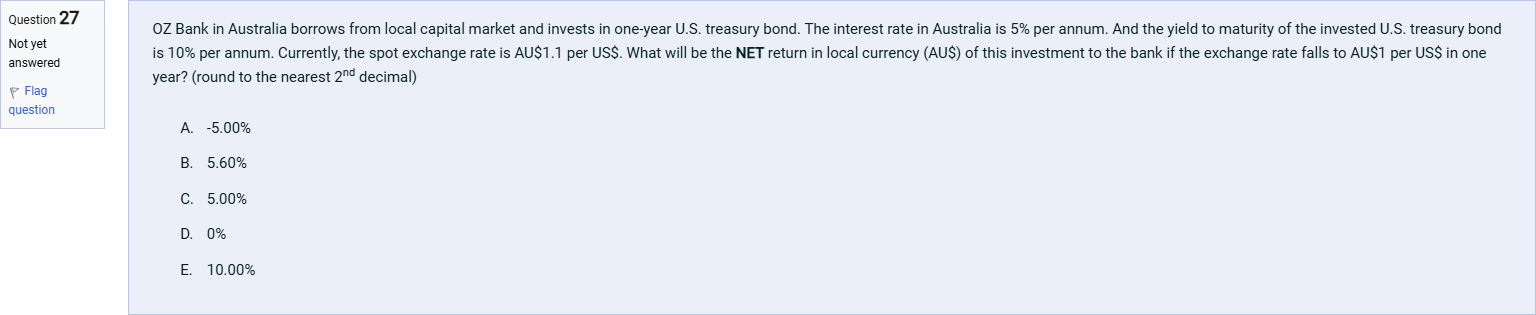

OZ Bank in Australia borrows from local capital market and invests in one-year U.S. treasury bond. The interest rate in Australia is 5% per annum. And the yield to maturity of the invested U.S. treasury bond is 10% per annum. Currently, the spot exchange rate is AU$1.1 per US$. What will be the NET return in local currency (AU$) of this investment to the bank if the exchange rate falls to AU$1 per US$ in one year? (round to the nearest 2nd decimal)

Options

A.A. -5.00%

B.B. 5.60%

C.C. 5.00%

D.D. 0%

E.E. 10.00%

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

To begin, restate the scenario and the numbers involved to keep track of cash flows clearly. OZ Bank borrows 1.10 AU$ (the amount needed to invest in 1 US$ at the current spot of 1.1 AU$/US$) and uses it to buy 1.00 US$ worth of a one-year US Treasury, which yields 10% over the year. The ......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

An American manufacturer with its corporate headquarters in New York City is purchasing goods from a French supplier. Which of the following statements is true regarding the exchange rate risk for this contract?

Question29 Assume that the exchange rate was AU$1.25/US$1 at 31/12/2006. One year later the exchange rate changed to AU$1/US$1. The rate of return in terms of US$ on the US$ assets was 10% from 12/31/2006 to 12/31/2007. What was the effective rate of return in terms of AU$ earned by this FI on the US$ assets? Select one alternative: a. -12% b. -10% c. +8% d. +10% e. +20% ResetMaximum marks: 3 Flag question undefined

An Indonesian student’s family purchased an apartment for AUD 1 million in the Melbourne CBD area for their son to stay in during his study at Monash College. The contract will be settled in 6 months. Which of the following statements is true regarding the exchange rate risk for the family?

An American manufacturer with its corporate headquarters in New York City is purchasing goods from a French supplier. Which of the following statements is true regarding the exchange rate risk for this contract?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!