Questions

Dashboard Unit 6 Quiz (test your knowledge on Unit 6 concepts)

Multiple dropdown selections

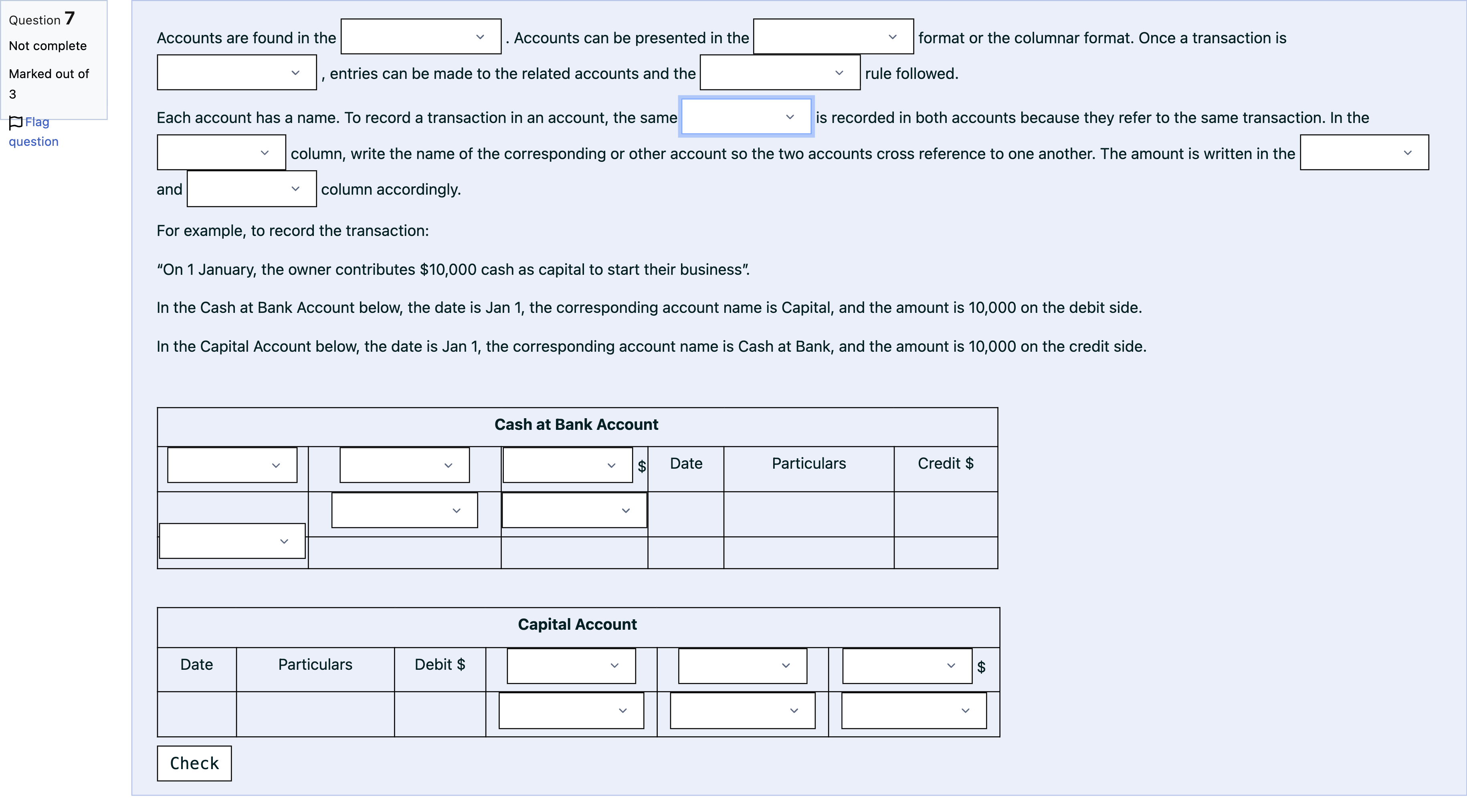

Accounts are found in the Blank 1 Question 7[select: , General Ledger, T, analysed, Double Entry] . Accounts can be presented in the Blank 2 Question 7[select: , General Ledger, T, analysed, Double Entry] format or the columnar format. Once a transaction is Blank 3 Question 7[select: , General Ledger, T, analysed, Double Entry] , entries can be made to the related accounts and the Blank 4 Question 7[select: , General Ledger, T, analysed, Double Entry] rule followed. Each account has a name. To record a transaction in an account, the same Blank 5 Question 7[select: , Date, Particulars, Debit, Credit] is recorded in both accounts because they refer to the same transaction. In the Blank 6 Question 7[select: , Date, Particulars, Debit, Credit] column, write the name of the corresponding or other account so the two accounts cross reference to one another. The amount is written in the Blank 7 Question 7[select: , Date, Particulars, Debit, Credit] and Blank 8 Question 7[select: , Date, Particulars, Debit, Credit] column accordingly. For example, to record the transaction: “On 1 January, the owner contributes $10,000 cash as capital to start their business”. In the Cash at Bank Account below, the date is Jan 1, the corresponding account name is Capital, and the amount is 10,000 on the debit side. In the Capital Account below, the date is Jan 1, the corresponding account name is Cash at Bank, and the amount is 10,000 on the credit side. [table] Cash at Bank Account Blank 9 Question 7 DateParticularsDebitCredit | Blank 10 Question 7 DateParticularsDebitCredit | Blank 11 Question 7 DateParticularsDebitCredit $ | Date | Particulars | Credit $ Blank 12 Question 7 1 JanuaryCapital$10,000Cash at bank | Blank 13 Question 7 1 JanuaryCapital$10,000Cash at bank | Blank 14 Question 7 1 JanuaryCapital$10,000Cash at bank | | | | | | | | [/table] [table] Capital Account Date | Particulars | Debit $ | Blank 15 Question 7 DateParticularsDebitCredit | Blank 16 Question 7 DateParticularsDebitCredit | Blank 17 Question 7 DateParticularsDebitCredit $ | | | Blank 18 Question 7 1 JanuaryCapital$10,000Cash at bank | Blank 19 Question 7 1 JanuaryCapital$10,000Cash at bank | Blank 20 Question 7 1 JanuaryCapital$10,000Cash at bank [/table]

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

The question is about completing a description of how accounts are recorded in double-entry bookkeeping and asks you to select the appropriate terms for each blank. Below I go option by option, explaining why each chosen term fits or does not fit, and I vary the language and flow to keep the reasoning diverse.

- Blank 1: General Ledger

The statement begins with where accounts are found. In bookkeeping, accounts reside in the General Ledger, which is the master collection of all accounts. Choosing General Ledger here correctly identifies the primary book where individual account records are kept, as opposed to, say, journals or subsidiary ledgers. Incorrect alternatives would misplace the location of accounts, for example suggesting they are found somewhere outside the main ledger structure.

- Blank 2: T

Accounts can be presented in a particular format. The classic presentation format for individual accounts is the T-account format, which visually resembles a letter T with debits on the left and credits on the right. This option aligns with the traditional method of displaying each account. Other choices would imply different presentation styles (like a narrative or full ledger listing) that aren’t the standard depictions used in basic double-entry examples.

- Blank 3: analysed

The clause says, “Once a transaction is …, entries can be made to the related accounts.” The term analysed fits here because before posting, a transaction must be examined and its effects on accounts understood. This reflects the step where you identify which accounts are involved and how they are affected. If you used a word like obser......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Using the table below, which columns are affected if the following transaction occurs 'Cash of $200 is received for passing go'.

Hangry Donuts is preparing to provide the catering for the launch of the startup UniRideShare. The business is owned by friends Sergeo, Grace and Ariadne. UniRideShare helps students get to uni by carpooling with other students. The business orders $3,250 worth of donuts for their launch event and is paying using the cryptocurrency Bitcoin. Select the flows and accounts that the business would use to record this transaction. Please choose a drop-down selection for every box. Assets = Liabilities + Equity [ Select ] [ Select ] [ Select ] [ Select ] [ Select ] [ Select ]

Hangry Donuts head baker is Jacqueline. She recommends that HD requires a larger oven and proposes that the owners take out a loan for $18,000 to purchase the new oven. The owners agree and a new oven is purchased. The bank pays the oven supplier directly for the equipment and begins the loan for HD. Select the flows and accounts that the business would use to record this transaction. Please choose a drop-down selection for every box. Assets = Liabilities + Equity [ Select ] [ Select ] [ Select ] [ Select ] [ Select ] [ Select ]

In which of the following scenarios are the increases and decreases in accounts not balanced?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!