Questions

Single choice

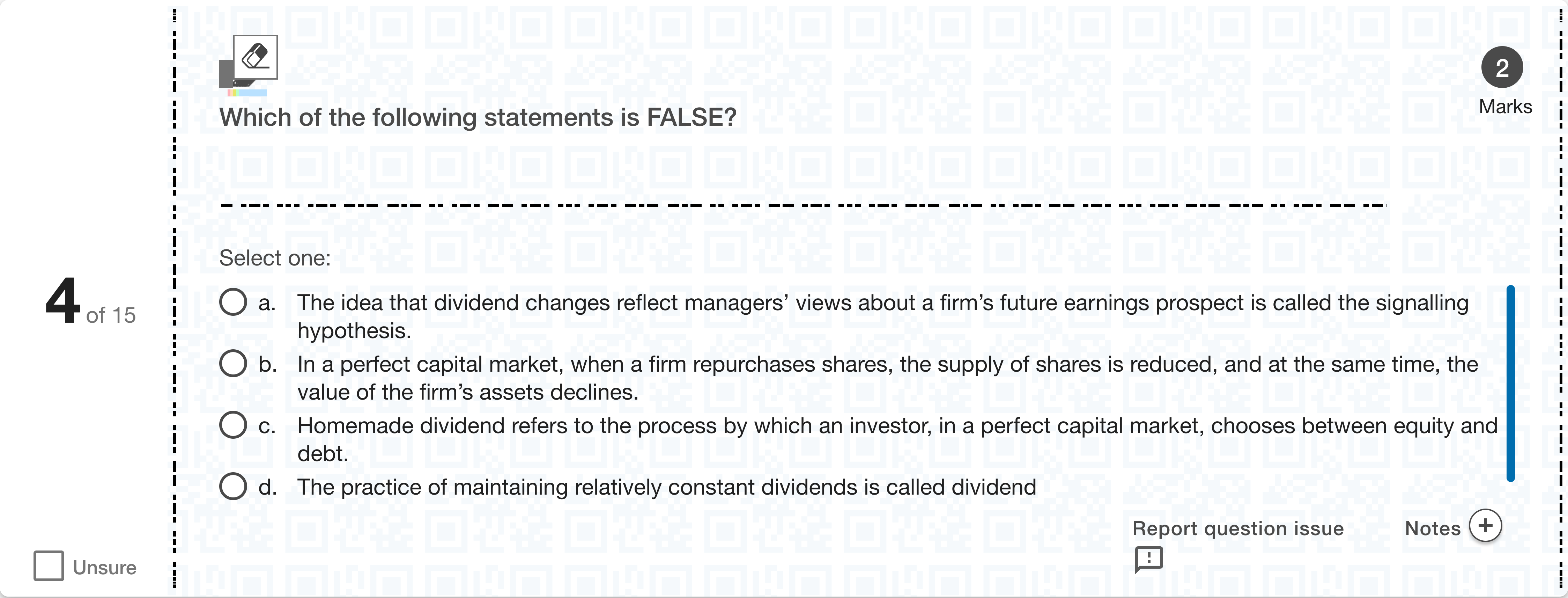

Which of the following statements is FALSE?[Fill in the blank]

Options

A.a. The idea that dividend changes reflect managers’ views about a firm’s future earnings prospect is called the signalling hypothesis.

B.b. In a perfect capital market, when a firm repurchases shares, the supply of shares is reduced, and at the same time, the value of the firm’s assets declines.

C.c. Homemade dividend refers to the process by which an investor, in a perfect capital market, chooses between equity and debt.

D.d. The practice of maintaining relatively constant dividends is called dividend smoothing.

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

The question asks which statement is FALSE. We will evaluate each option in turn to see whether it accurately reflects financial theory.

Option a: 'The idea that dividend changes reflect managers’ views about a firm’s future earnings prospect is called the signalling hypothesis.' This is a standard description of the signalling hypothesis in dividend policy: managers convey information about future earnings through changes in d......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

CANADIAN TIRE- Part 7 of 11 A young investor who prioritizes long-term growth over income is selecting stocks for her portfolio. She is comfortable with volatility and wants companies that reinvest aggressively in itself. If Walmart Dividend Payout Ratio is 5%, then investors would choose:

Regarding payout policy, select the correct statement:

Regarding payout policy, select the correct statement:

If a firm has a positive NPV project but cannot raise equity or capital to do it, then it can obtain the funds by temporarily cutting its regular dividends and this will generally have little or no impact on its stock price.

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!