Questions

MCD2170 Foundations of Finance - Trimester 3 - 2025

Single choice

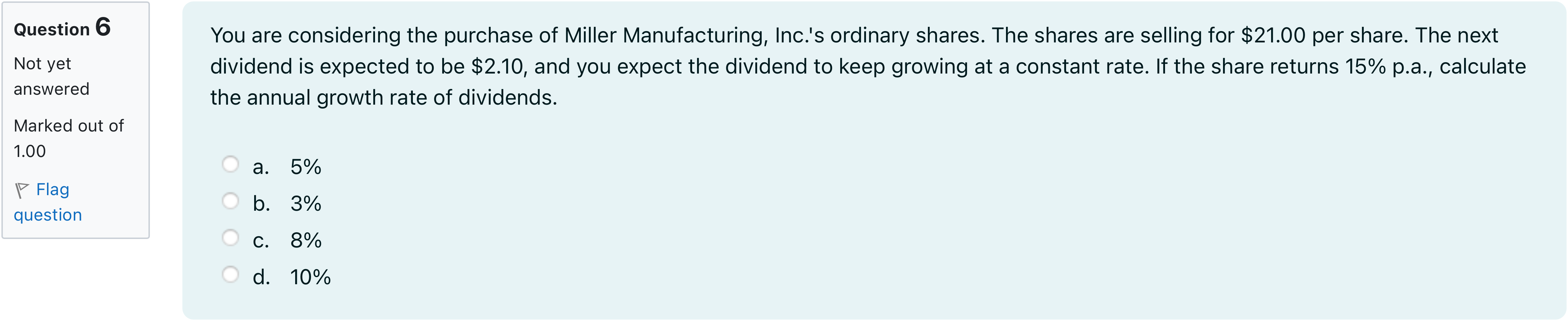

You are considering the purchase of Miller Manufacturing, Inc.'s ordinary shares. The shares are selling for $21.00 per share. The next dividend is expected to be $2.10, and you expect the dividend to keep growing at a constant rate. If the share returns 15% p.a., calculate the annual growth rate of dividends.

Options

A.a. 5%

B.b. 3%

C.c. 8%

D.d. 10%

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

We start by restating the given data to keep the scenario clear: the current share price P0 is 21.00, the next dividend D1 is 2.10, and the required return (cost of equity) r is 15% or 0.15. The dividends are expected to grow at a constant rate g, which implies the ......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Company ABC’s ordinary shares are currently selling at $24.00 per share. The company is expected to pay a dividend of $1.92 per share, which is predicted to grow at 4% per annum forever. What is the share's expected rate of return?

Company ABC’s ordinary shares are currently selling at $24.00 per share. The company is expected to pay a dividend of $1.92 per share, which is predicted to grow at 4% per annum forever. What is the share's expected rate of return?

Asgard Industries stock has a beta of 1.03. The company just paid a dividend of $0.7, and the dividends are expected to grow at 6.2 percent indefinitely. The expected return on the market is 13.3 percent, and Treasury bills are yielding 3.8 percent. The most recent stock price for the company is $9.04. Calculate the cost of equity using the Dividend Growth Model (DGM) method.Note: Do not round intermediate calculations and enter your answer as a percentage rounded to 2 decimal places (e.g., 32.16 and not 32.16% or 0.3216).FIN256-2025-Fall-Final-Blank.xlsx

The Snow Owl Company just issued a dividend of $3.32 per share on its common stock. The company is expected to maintain a constant 8 percent growth rate in its dividends indefinitely. If the stock sells for $70 a share, what is the company’s cost of equity?Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.Blank.xlsx

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!