Questions

MCD2170 Foundations of Finance - Trimester 3 - 2025

Single choice

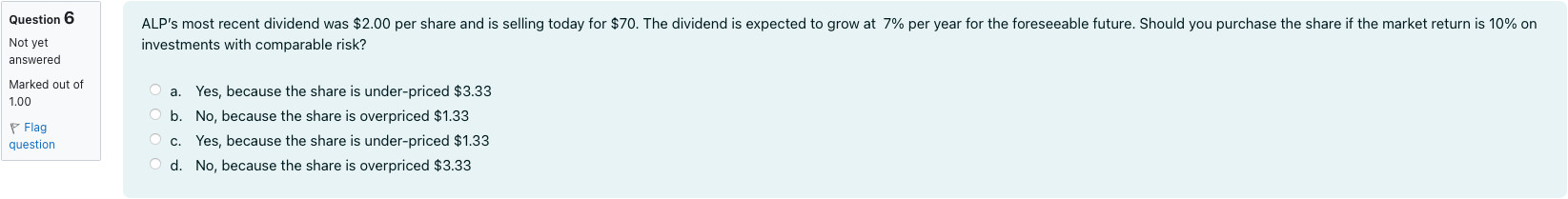

ALP’s most recent dividend was $2.00 per share and is selling today for $70. The dividend is expected to grow at 7% per year for the foreseeable future. Should you purchase the share if the market return is 10% on investments with comparable risk?

Options

A.a. Yes, because the share is under-priced $3.33

B.b. No, because the share is overpriced $1.33

C.c. Yes, because the share is under-priced $1.33

D.d. No, because the share is overpriced $3.33

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

We start by identifying the key inputs: last dividend D0 = $2.00, growth g = 7% per year, required market return r = 10% for investments with comparable risk, and the stock price today P0 = $70.

Option a asks whether to buy if the share is under-priced by $3.33 and that you should buy if a is true. To check, compute the value from the dividend growth model.

Step 1: Compute the next dividend

D1 = D0 × (1 + g) = 2.00 × 1.07 = 2.14.

Step 2: Compute the intrinsic value usin......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

You are evaluating the purchase of Somners Resources' ordinary shares that just paid a dividend of $1.80. You expect the dividend to grow at a rate of 12%, indefinitely. You estimate that a required rate of return of 17.5% will be adequate compensation for this investment. Assuming that your analysis is correct, what is the highest price you would be willing to pay per share if you were to purchase them today?

You are evaluating Stock ABC, which has recently paid an annual dividend of $5.75 per share. The company is expected to experience significant growth, with dividends growing at a rate of 10% annually for the next 5 years. After this high-growth period, the dividend growth rate is expected to slow down to 6% indefinitely. Investors require a 10% return on this stock. Given this information, what is the estimated value of one share of Stock ABC?

ABC, Inc. just paid a dividend of $2. ABC expects dividends to grow at 10% annually forever. The return on shares like ABC, Inc. is typically around 12%. What is the most you would pay for ABC’s share?

Using a dividend discount model, find the intrinsic value (price at time zero) for a firm whose expected dividend is $1.92 and growth in dividends for year 2, 3, and 4 is 23.2% and constant growth afterwards is 0.54%. The cost of equity is 9.21%. (Answer in 2 decimal places, 6.21 for $6.21).

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!