Questions

FINS5512-Financial Markets & Institutions - T3 2025

Single choice

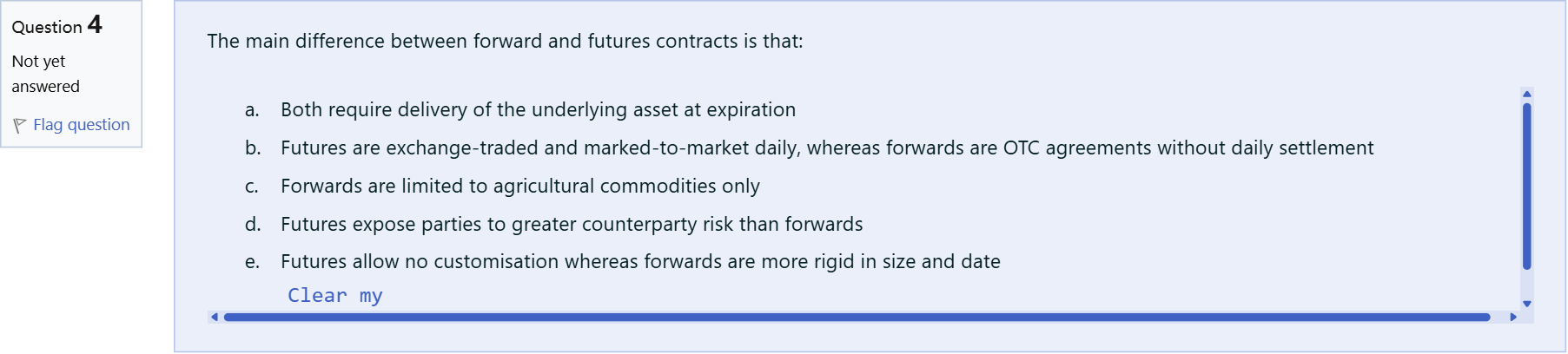

The main difference between forward and futures contracts is that:

Options

A.a. Both require delivery of the underlying asset at expiration

B.b. Futures are exchange-traded and marked-to-market daily, whereas forwards are OTC agreements without daily settlement

C.c. Forwards are limited to agricultural commodities only

D.d. Futures expose parties to greater counterparty risk than forwards

E.e. Futures allow no customisation whereas forwards are more rigid in size and date

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

Here is a breakdown of each option for the question: 'The main difference between forward and futures contracts is that:'

Option a: 'Both require delivery of the underlying asset at expiration' This is not accurate as a general statement. Forwards and futures can be settled by delivery in some cases, but many positions are settled in cash or offset before expiration. The key distinction is not solely about delivery versus cash settle......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

We are able to sell or go short futures and forwards, even when we don't own them, because they are derivatives. This means a contract is created each time a buyer and seller make a new transaction.

From a financial standpoint, futures are virtually identical to forwards

Part 1Financial instruments with returns tied to previously issued securities are called:Part 2 A. financial derivatives B. reversible bonds C. hedge securities D. convertible bonds

Which market involves the trading of derivative securities?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!