Questions

FINS5530-Financial Institution Mgmt - T3 2025

Single choice

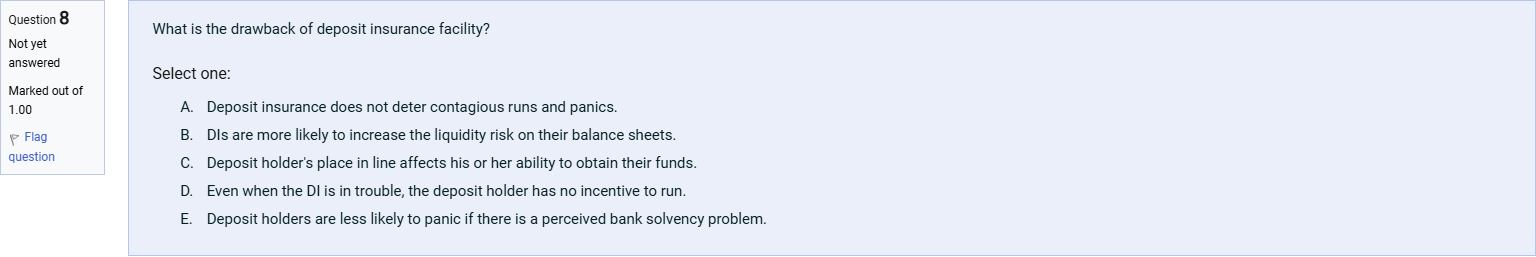

What is the drawback of deposit insurance facility?

Options

A.A. Deposit insurance does not deter contagious runs and panics.

B.B. DIs are more likely to increase the liquidity risk on their balance sheets.

C.C. Deposit holder's place in line affects his or her ability to obtain their funds.

D.D. Even when the DI is in trouble, the deposit holder has no incentive to run.

E.E. Deposit holders are less likely to panic if there is a perceived bank solvency problem.

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

First, let's restate the question and options to ensure clarity about what's being evaluated.

Question: What is the drawback of deposit insurance facility?

Options:

A. Deposit insurance does not deter contagious runs and panics.

B. DIs are more likely to increase the liquidity risk on their balance sheets.

C. Deposit holder's place in line affects his or her ability to obtain their funds.

D. Even when the DI is in trouble, the deposit holder has no incentive to run.

E. Deposit holders are less likely to panic if there is a perceived bank solvency problem.

Now, evaluate each option carefully:

Option A: Deposit insurance does not deter contagious runs and panics.

- Analysis: This statement captures a known drawback of some deposit insur......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Risk-based deposit insurance premiums help control moral hazard by:

Which of the following outcomes is most directly attributable to the absence of a fully mutualised European Deposit Insurance Scheme (EDIS)?

A key reason full European Deposit Insurance Scheme has faced political resistance is that:

A key reason full European Deposit Insurance Scheme has faced political resistance is that:

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!