Questions

Single choice

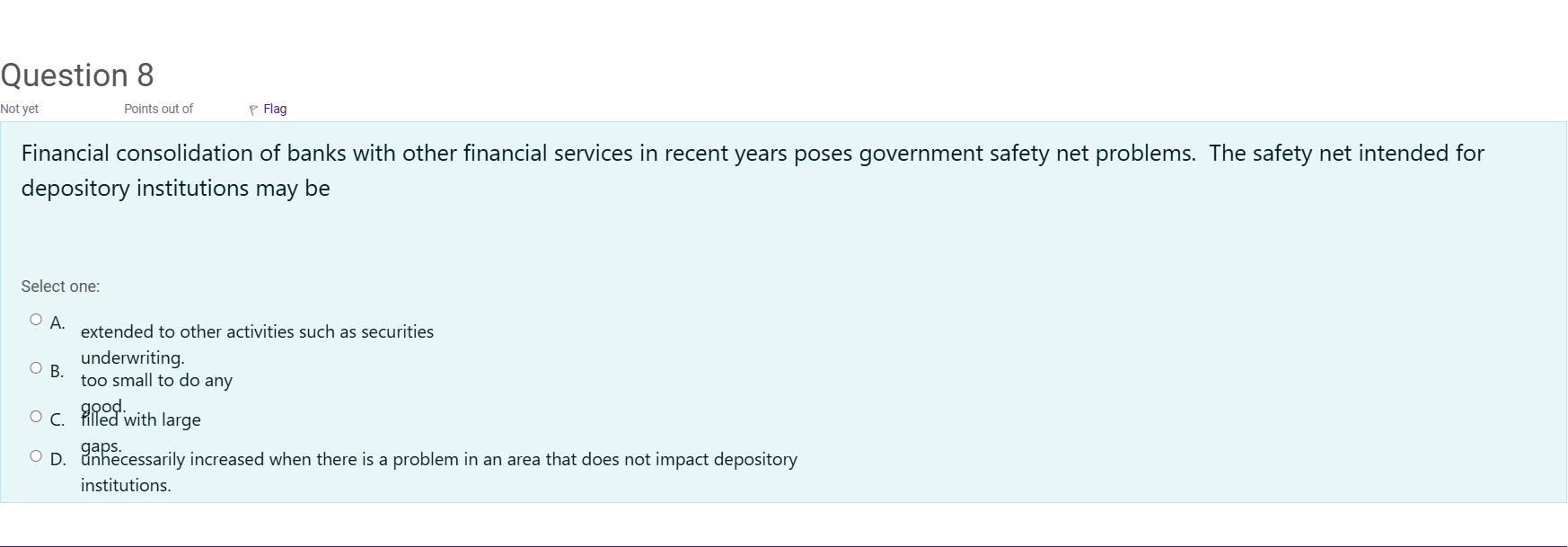

Financial consolidation of banks with other financial services in recent years poses government safety net problems. The safety net intended for depository institutions may be

Options

A.A. extended to other activities such as securities underwriting.

B.B. too small to do any good.

C.C. filled with large gaps.

D.D. unnecessarily increased when there is a problem in an area that does not impact depository institutions.

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

The question examines how the government safety net for depository institutions has evolved in the context of bank consolidation with other financial services.

Option A: 'extended to other activities such as securities underwriting.' This choice reflects a widely observed concern: when a safety net covers depository institutions, the protections and guarantees can become relevant for related activities that these institutio......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Risk-based deposit insurance premiums help control moral hazard by:

Which of the following outcomes is most directly attributable to the absence of a fully mutualised European Deposit Insurance Scheme (EDIS)?

A key reason full European Deposit Insurance Scheme has faced political resistance is that:

A key reason full European Deposit Insurance Scheme has faced political resistance is that:

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!