题目

FINS3635-Options, Futures & Risk Mgmt - T3 2025

单项选择题

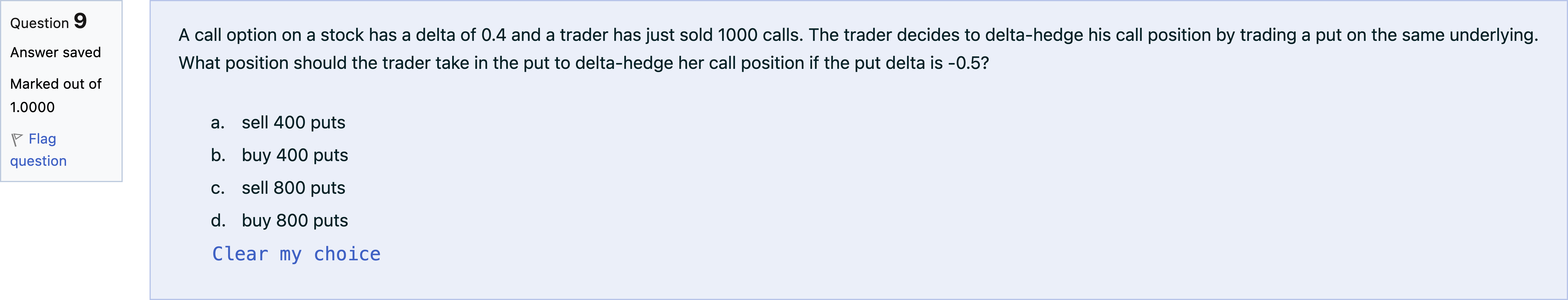

A call option on a stock has a delta of 0.4 and a trader has just sold 1000 calls. The trader decides to delta-hedge his call position by trading a put on the same underlying. What position should the trader take in the put to delta-hedge her call position if the put delta is -0.5?

选项

A.a. sell 400 puts

B.b. buy 400 puts

C.c. sell 800 puts

D.d. buy 800 puts

查看解析

标准答案

Please login to view

思路分析

First, translate the given deltas into a hedge target. The trader has sold 1000 calls with a delta of 0.4 each, so the total call delta position is +400 (since selling calls yields a negative exposure, but delta effectively......Login to view full explanation登录即可查看完整答案

我们收录了全球超50000道考试原题与详细解析,现在登录,立即获得答案。

类似问题

When you established the hedged options trade, as in the assignment, what would have been your P&L the first day if these had been the call and stock prices (numbers slightly modified from the original, in part for ease of calculation):

You buy call options on a stock index, and wish to trade shares of the underlying stock index to establish a delta-neutral position. To maintain a delta neutral position, you will need to:

You purchase put options on a stock index, and wish to trade shares of the underlying stock index to establish a delta-neutral position. To maintain a delta neutral position, you will need to:

A call option on a stock has a delta of 0.7 and a trader has just sold 1000 calls. The trader decides to delta-hedge his call position by trading a put on the same underlying. What position should the trader take in the put to delta-hedge her call position if the put delta is -0.5?

更多留学生实用工具

希望你的学习变得更简单

加入我们,立即解锁 海量真题 与 独家解析,让复习快人一步!