Still overwhelmed by exam stress? You've come to the right place!

We know exam season has you totally swamped. To support your studies, access Gold Membership for FREE until December 31, 2025! Normally £29.99/month. Just Log In to activate – no strings attached.

Let us help you ace your exams efficiently!

Questions

Short answer

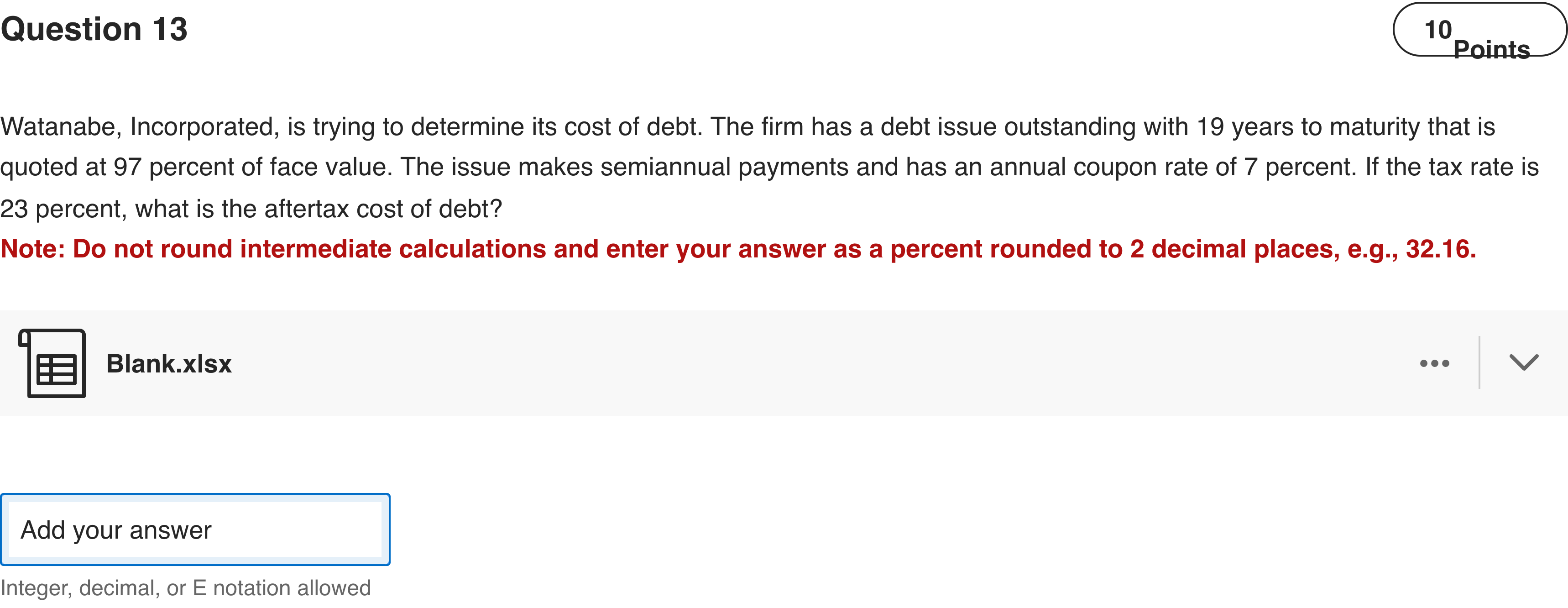

Watanabe, Incorporated, is trying to determine its cost of debt. The firm has a debt issue outstanding with 19 years to maturity that is quoted at 97 percent of face value. The issue makes semiannual payments and has an annual coupon rate of 7 percent. If the tax rate is 23 percent, what is the aftertax cost of debt?Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.Blank.xlsx

View Explanation

Standard Answer

Please login to view

Approach Analysis

We need to determine the aftertax cost of debt for a bond with these given features.

First, restate the key data: the bond has 19 years to maturity, is priced at 97% of face value, pays semiannual coupons, and has an annual coupon rate of 7%. The corporate tax rate is 23%. The aftertax cost of debt is typically calculated as the yield to maturity (YTM) on the debt, multiplied by (1 − tax rate).

Step 1: Iden......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Watanabe, Incorporated, is trying to determine its cost of debt. The firm has a debt issue outstanding with 19 years to maturity that is quoted at 97 percent of face value. The issue makes semiannual payments and has an annual coupon rate of 7 percent. If the tax rate is 23 percent, what is the aftertax cost of debt?Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.Blank.xlsx

Wright Market Research is able to borrow money at a rate of 6.8 percent per year. This interest rate is called the:

Too Young, Incorporated, has a bond outstanding with a coupon rate of 6.2 percent and semiannual payments. The bond currently sells for $943 and matures in 19 years. The par value is $1,000. What is the company's pretax cost of debt?

Which of the following statements regarding a firm’s pretax cost of debt is accurate?

More Practical Tools for International Students

Making Your Study Simpler

To make preparation and study season easier for more international students, we've decided to open up Gold Membership for a limited-time free trial until December 31, 2025!