Questions

Unknown Question Type

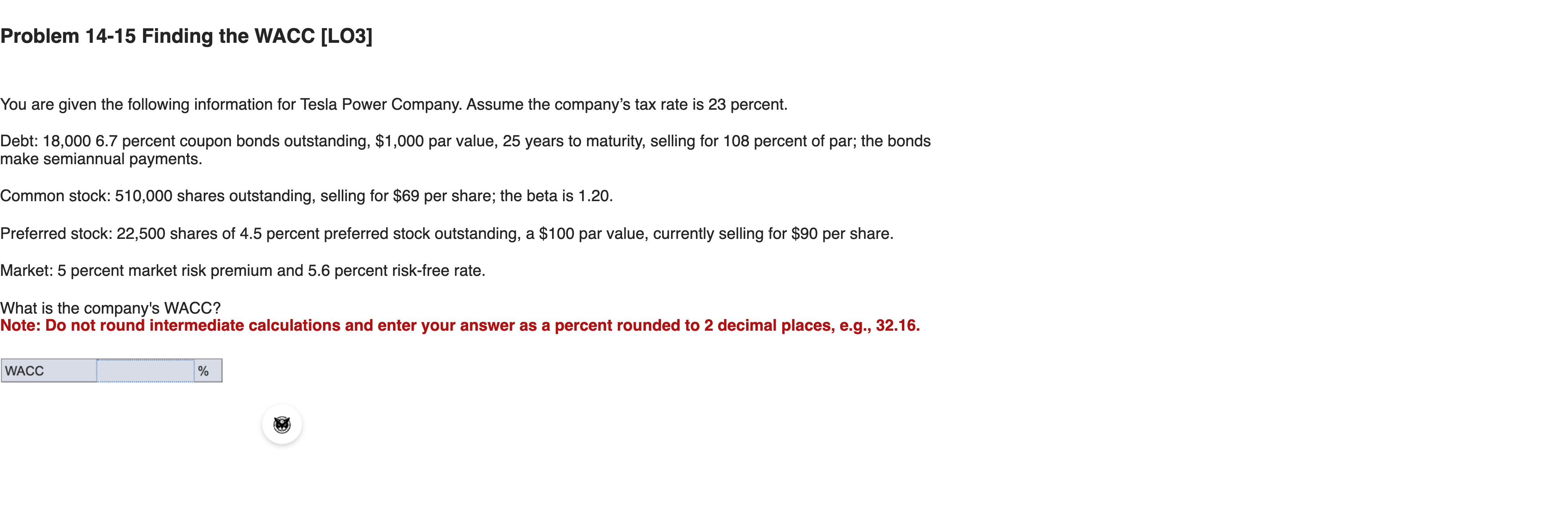

Problem 14-15 Finding the WACC [LO3] You are given the following information for Tesla Power Company. Assume the company’s tax rate is 23 percent. Debt: 18,000 6.7 percent coupon bonds outstanding, $1,000 par value, 25 years to maturity, selling for 108 percent of par; the bonds make semiannual payments. Common stock: 510,000 shares outstanding, selling for $69 per share; the beta is 1.20. Preferred stock: 22,500 shares of 4.5 percent preferred stock outstanding, a $100 par value, currently selling for $90 per share. Market: 5 percent market risk premium and 5.6 percent risk-free rate. What is the company's WACC? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

We start by restating the given information and identifying the components needed for WACC.

- Tax rate: 23%

- Debt: 18,000 bonds, 6.7% coupon, par 1,000, 25 years to maturity, price 108% of par, semiannual coupons.

- Common stock: 510,000 shares, price 69, beta 1.20.

- Preferred stock: 22,500 shares, 4.5% (of par) preferred, par 100, price 90.

- Market data: risk-free rate 5.6%, market risk premium 5% (implying equity market expected return around 11.6% via CAPM).

- Objective: compute WACC = w_d · after_tax_cost_of_debt + w_e · cost_of_equity + w_p · cost_of_preferred.

1) Cost of debt (after tax)

- Each bond pays a semiannual coupon of 6.7% of par per year, i.e., 67 ......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

A firm has equity market capitalization of $200 and $100 in debt. The beta is 2. The swaps curve is flat at 3%. The credit spread on the firm's debt is 2%. It plans to finance a $10 project with debt. You can ignore taxes. The risk premium on the market portfolio is 4%. In theory, this project makes sense if the expected IRR >

An analyst assesses a company as below average on ESG metrics. All other matters being equal, the analyst is most likely to:

An analyst assesses a company as below average on ESG metrics. All other matters being equal, the analyst is most likely to:

A company is evaluating a new national integrated marketing communications (IMC) campaign intended to expand penetration in an underserved demographic. The campaign requires a $10 million upfront investment and is projected to generate incremental cash flows over five years through brand equity growth, customer acquisition, and increased lifetime value. The company’s hurdle rate is 9%, and the CFO insists that any IMC initiative must meet or exceed this hurdle rate to be approved. Which explanation best captures why the CFO uses the cost of capital as a hurdle rate for evaluating the IMC investment?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!