Questions

FIN.256.M016.FALL25.Principles of Finance Final Prep LockDown Browser FIN.256.M016.FALL25.Principles of Finance Final Prep LockDown Browser

Multiple fill-in-the-blank

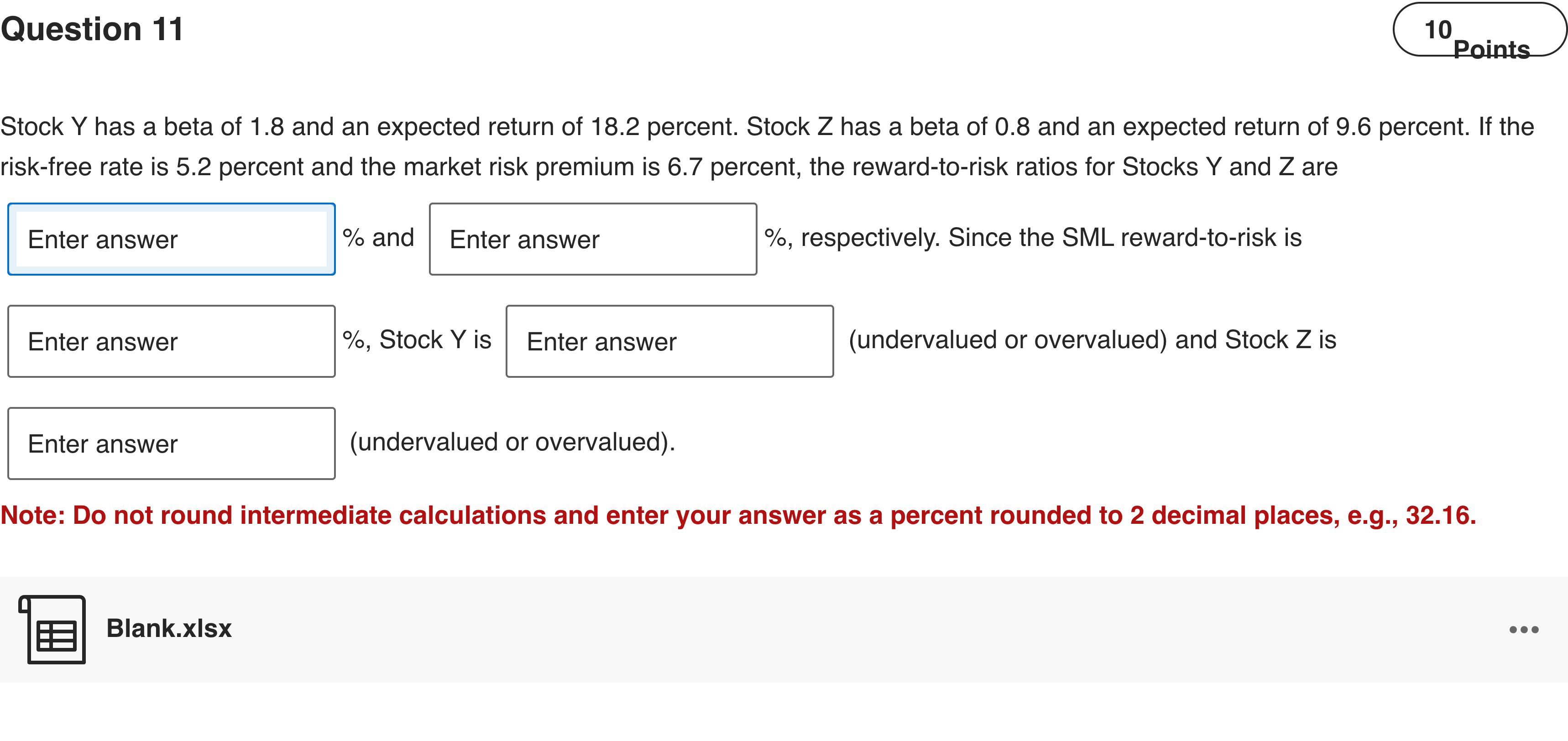

Stock Y has a beta of 1.8 and an expected return of 18.2 percent. Stock Z has a beta of 0.8 and an expected return of 9.6 percent. If the risk-free rate is 5.2 percent and the market risk premium is 6.7 percent, the reward-to-risk ratios for Stocks Y and Z are [input]% and [input]%, respectively. Since the SML reward-to-risk is [input]%, Stock Y is [input] (undervalued or overvalued) and Stock Z is [input] (undervalued or overvalued).Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.Blank.xlsx

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

The question asks us to compute the reward-to-risk ratios for Stocks Y and Z using the given data, identify the SML reward-to-risk, and then classify each stock as undervalued or overvalued.

First, determine the reward-to-risk ratio for Stock Y. The formula is: (Expected Return − Risk-free Rate) / Beta.

- For Y: E(R_Y) = 18.2%, ......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

In the CAPM regression: 𝑅 𝑖 − 𝑅 𝑓 = 𝛼 𝑖 + 𝛽 𝑖 × ( 𝑅 𝑚 − 𝑅 𝑓 ) + 𝜖 𝑖 which statement is the most accurate?

Assume that CAPM holds. An analyst estimated the following risk-reward ratio for the market: 𝐸 [ 𝑅 𝑀 ] − 𝑅 𝑓 𝜎 𝑀 2 =20% The covariance of Stock A and the market portfolio is -0.45%. The risk-free rate is 3%. What is Stock A's expected return? Enter your final answer as a percentage rounded to two decimal places, and input only the number (no “%” sign). For example, enter -5.41 (not -5.41%) or 7.35 (not 7.35%).

Assume that CAPM holds. ETF Z combines only Stock X and Stock Y. According to the market, the expected return of ETF Z is 15% and its alpha is 3%. You know that Stock X's beta is 1.0 and Stock Y's beta is 2.0, the expected return of the market is 9% and the risk-free rate is 4%. Determine Stock X's alpha if 𝛼 𝑋 = 3 𝛼 𝑌 . Enter your final answer as a percentage rounded to two decimal places, and input only the number (no “%” sign). For example, enter -5.41 (not -5.41%) or 7.35 (not 7.35%).

Select all of the below statements that are true.

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!