Questions

MCD2170 Foundations of Finance - Trimester 3 - 2025

Single choice

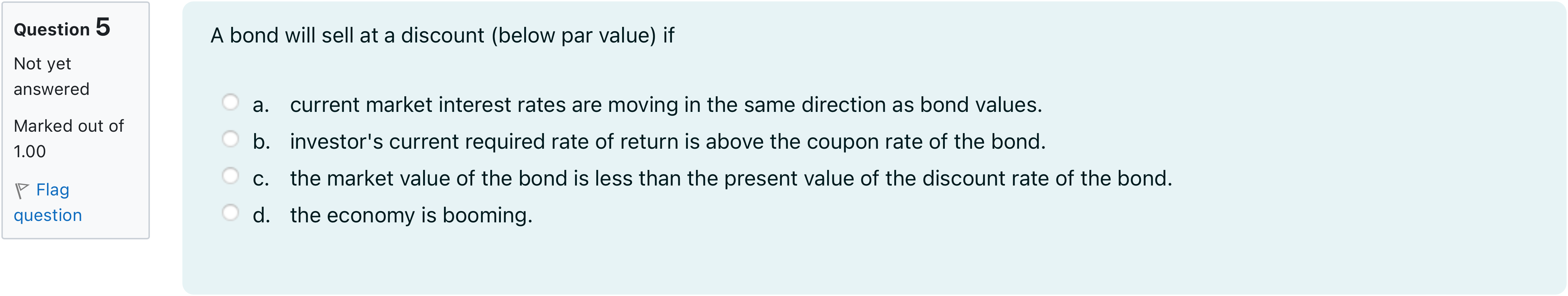

A bond will sell at a discount (below par value) if

Options

A.a. current market interest rates are moving in the same direction as bond values.

B.b. investor's current required rate of return is above the coupon rate of the bond.

C.c. the market value of the bond is less than the present value of the discount rate of the bond.

D.d. the economy is booming.

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

When a bond trades at a discount (below par), its price is less than its face value. This occurs because investors require a higher return than the bond's coupon payments alone provide, so the market adjusts the price downward to meet the desired yield.

Option a: 'current market interest rates are moving in the same direction as bond values.' This......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

As interest rates rise, the market price of your bond is also likely to rise.

You have purchased a bond with a 7% annual coupon rate for $1,060. What will happen to the bond's price if market interest rates rise?

ACR'TERYX- Part 1a of 11 Arc’teryx is looking to raise cash to complete the full-development of their new retail store in Langley. The firm decides to issue a bond to finance this project. The face value of the bond is $3.5 million, which is issued on January 1, 2021. The 5% bond pays interests annually, and matures in 6 years. On January 1, 2021, bonds in the market with same maturity and risk as the Arc’teryx bond, had an interest rate of 8%. After issuing the bond, the corporate office of the firm decides to use the effective-interest rate method for amortizing the bond. Do not use symbols like $ or %, or text such as million, in your answers. Round to two decimal points. If the answer is 2.58456784 million, please write 2,584,567.84 What is the price of the bond issued on January 1, 2021?

On January 1st, 2005, Borrower Limited sold a 10%, five-year, $100 million bond when bonds of equivalent risk and maturity were yielding 5% annually. Interest payments are made on January 1st next year. What is the Price of the Bond?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!