Questions

FINS3635-Options, Futures & Risk Mgmt - T3 2025

Single choice

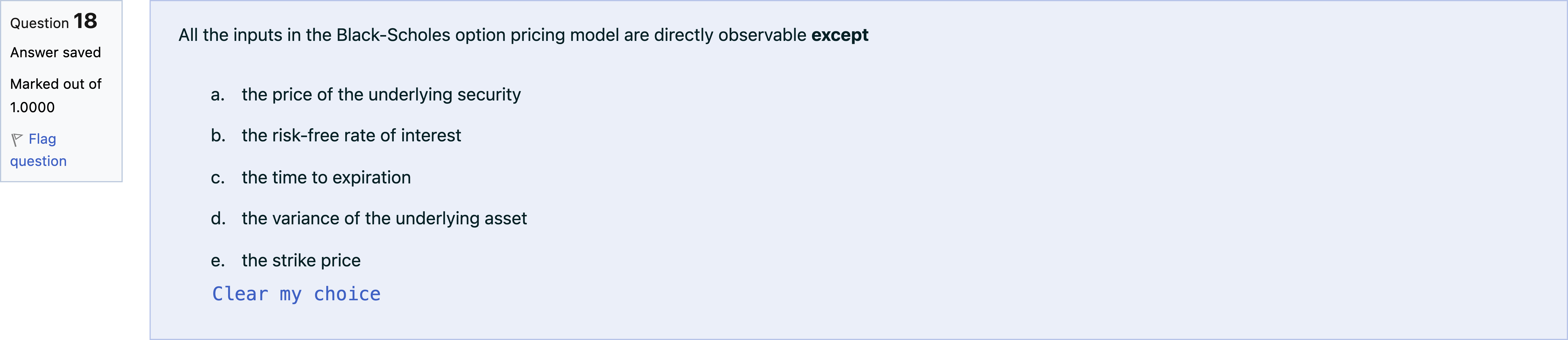

All the inputs in the Black-Scholes option pricing model are directly observable except

Options

A.a. the price of the underlying security

B.b. the risk-free rate of interest

C.c. the time to expiration

D.d. the variance of the underlying asset

E.e. the strike price

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

In this question about the Black–Scholes option pricing model, we evaluate which inputs are directly observable versus inferred.

Option a: the price of the underlying security. The current price of the underlying asset is a market quote that is readily observable in real time. This input is clearly observable, so this option is not the c......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

You have the following information (make sure to round d1 and d2 to two decimals): S = 85 K = 100 r = 5% t = 9 months implied volatility (standard deviation) = 50% The value of the call is closest to:

Question11 Apple stock currently sells for $40. The strike price on a call option with 6 months until expiration is $45. The continuously compounded risk-free rate is 4.0% and the Apple’s stock standard deviation is 0.40. Calculate the price of the call option on Apple stock using the Black-Scholes option pricing model. (Note: Use the provided Standard Normal Table to obtain the correct value from the options below. If you use your calculator you will not find any of the values below.) A. $2.65 B. $3.07 C. $5.53 D. $15.37 ResetMaximum marks: 2 Flag question undefined

Which of the following statements about the Black-Scholes Model (BSM) is most likely true?

Which of the following statements about the Black-Scholes Model (BSM) is most likely true?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!