Questions

MCD2170 - T3 - 2025 Week 10 post class homework

Single choice

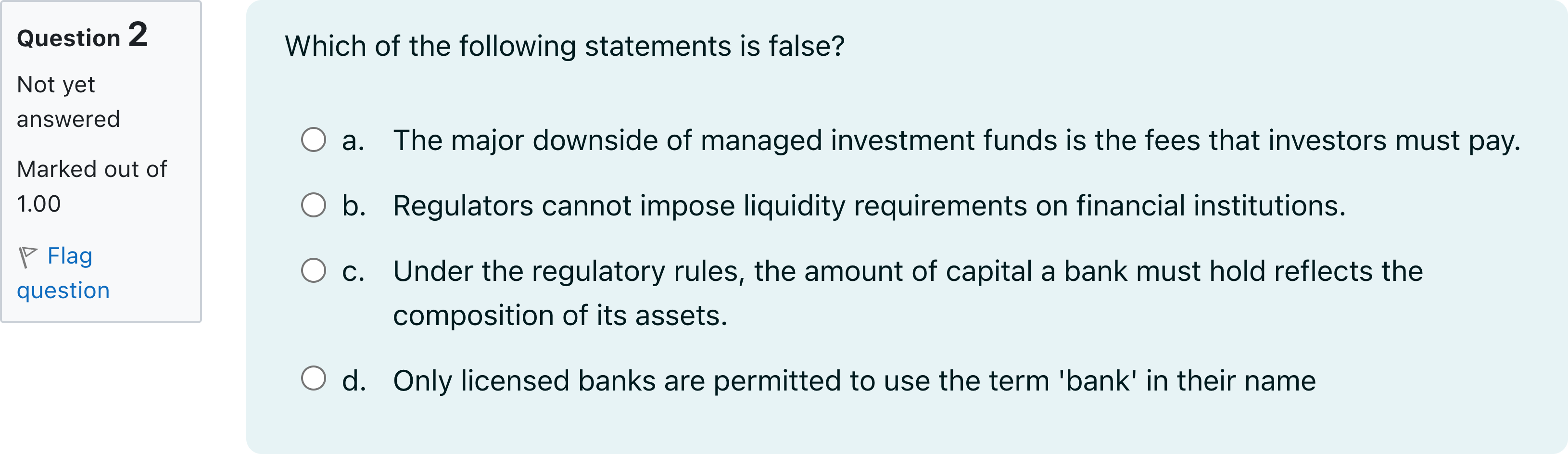

Which of the following statements is false?

Options

A.a. The major downside of managed investment funds is the fees that investors must pay.

B.b. Regulators cannot impose liquidity requirements on financial institutions.

C.c. Under the regulatory rules, the amount of capital a bank must hold reflects the composition of its assets.

D.d. Only licensed banks are permitted to use the term 'bank' in their name

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

Let's examine each statement to identify which one is false.

Option a: The major downside of managed investment funds is the fees that investors must pay. This is generally true in many contexts, as management fees, expense ratios, and other costs can erode returns, which is a common criticism of ac......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Countries around the world adopt bank regulation broadly consistent with the framework issued by the Basel Committee because

The net regulatory burden on financial institutions refers to:

The supervisory and regulatory activities of each Federal Reserve Bank in its district includes the authority to do which of the following?

Each Federal Reserve Bank has supervisory and regulatory authority over the activities of Blank ______ and Blank ______ located in their districts.

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!