Questions

BFC3240 - S2 2025 Mock Exam

Single choice

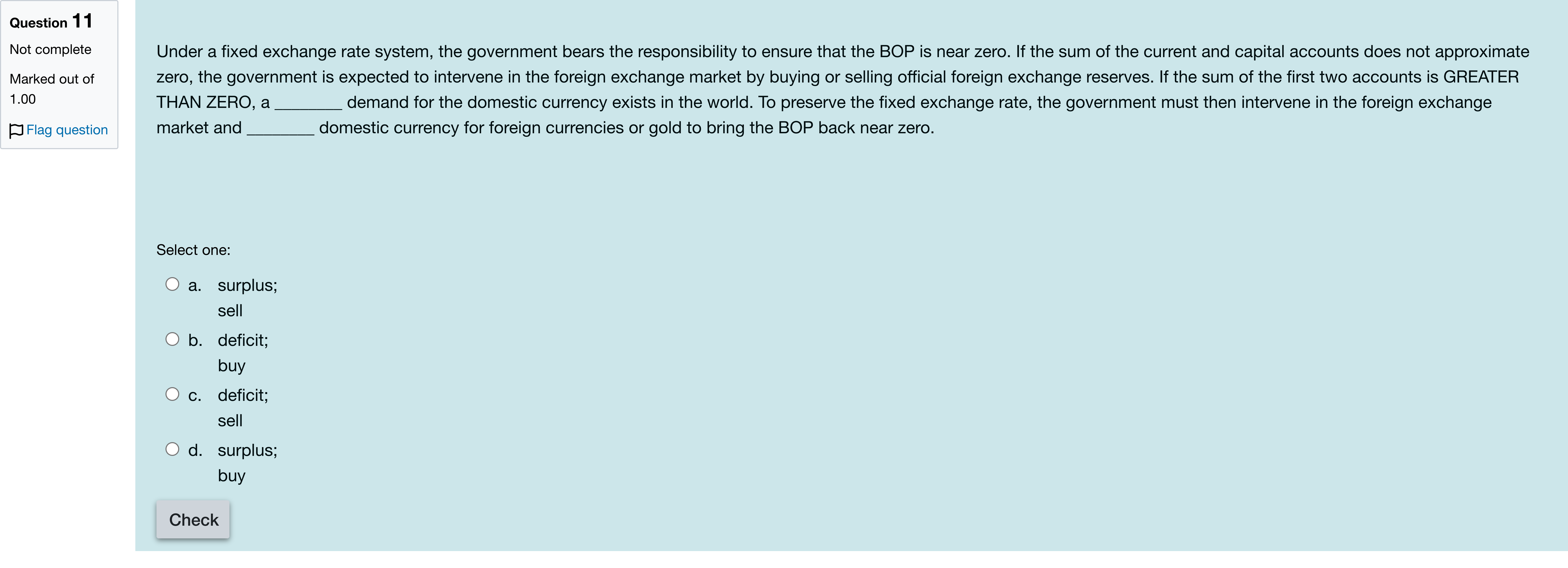

Under a fixed exchange rate system, the government bears the responsibility to ensure that the BOP is near zero. If the sum of the current and capital accounts does not approximate zero, the government is expected to intervene in the foreign exchange market by buying or selling official foreign exchange reserves. If the sum of the first two accounts is GREATER THAN ZERO, a ________ demand for the domestic currency exists in the world. To preserve the fixed exchange rate, the government must then intervene in the foreign exchange market and ________ domestic currency for foreign currencies or gold to bring the BOP back near zero.

Options

A.a. surplus; sell

B.b. deficit; buy

C.c. deficit; sell

D.d. surplus; buy

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

To tackle this question, I’ll walk through what happens when the sum of the current and capital accounts is greater than zero under a fixed exchange rate system.

Option a: surplus; sell. If CA + KA > 0, there is a BOP surplus meaning there is excess demand for domestic currency abroad as the world needs to acquir......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Balance of payment (BOP) data may be important for any of the following reasons:

Table 1 below gives information on the Balance of Payments of Country Z. Referring to the table below, what is the value of net primary income? Table 1[Fill in the blank]

An Australian company buys and sets up a factory for production in Singapore, in which part of Australia’s Balance of Payments would this transaction be recorded?[Fill in the blank]

Foreign investors buy Australian bonds worth $100 (Australian dollars) and receive a dividend worth $10 (Australian dollar). In Australia's balance of payments,

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!