Questions

Dashboard Assessable Quiz - Monopoly Challenge Week

Single choice

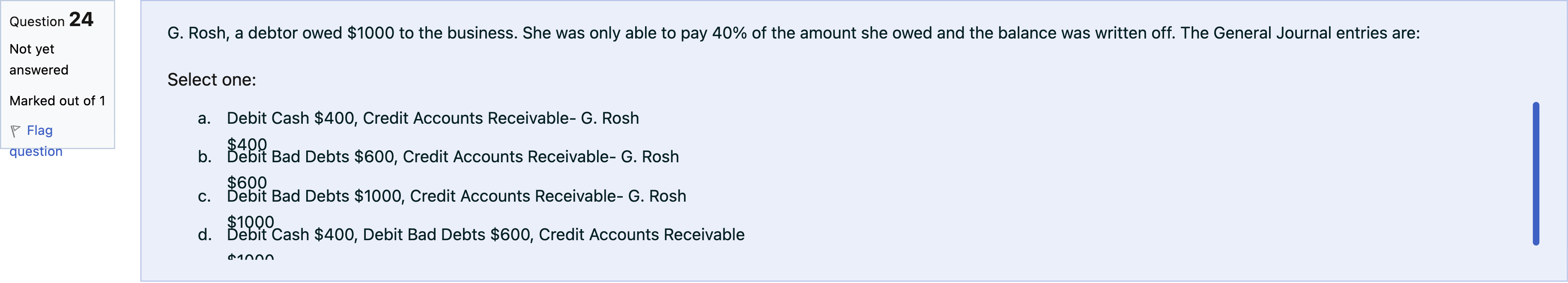

G. Rosh, a debtor owed $1000 to the business. She was only able to pay 40% of the amount she owed and the balance was written off. The General Journal entries are:

Options

A.a. Debit Cash $400, Credit Accounts Receivable- G. Rosh $400

B.b. Debit Bad Debts $600, Credit Accounts Receivable- G. Rosh $600

C.c. Debit Bad Debts $1000, Credit Accounts Receivable- G. Rosh $1000

D.d. Debit Cash $400, Debit Bad Debts $600, Credit Accounts Receivable $1000

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

The question describes a debtor who owed $1000 and paid 40% of the amount. The remaining $600 is written off as bad debt. Now, we evaluate each proposed journal entry to see which one correctly records the transaction.

Option a: Debit Cash $400, Credit Accounts Receivable- G. Rosh $400.

This entry recognizes the cash received, but it ignores the need to write off the remaining $60......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

You are the accountant for Kleenix Ltd. Debtor, Jones Ltd has an outstanding balance of $1200. You have been informed that Jones Ltd has been declared bankrupt and Kleenix Ltd receives 40c in the dollar. Which of the following is the correct accounting entry to record this transaction

If a company is experiencing higher writeoffs of account receivables than were estimated,

Question textSelected transactions for First Quality Designs, an interior decorator, in its first month of business, June are as follows: [table] 1 | | Invoiced customers $1,844 for services performed. 2. | | Received $630 cash from customers invoiced [/table] Additional information Raise an allowance for Doubtful Debts of $200 The ledger extract after these transactions and the balance day adjustment was as follows [table] Accounts Receivable Date | | Details | | Dr | Date | | Details | | Cr June 30 | | A/c Receivable | | 1,844 | June 30 | | Bank | | 630 | | | | | | | Balance | | 1,214 | | | | 1,844 | | | | | 1,844 July 1 | | Balance | | 1,214 | | | | | | | | | | | | | | [/table] [table] Allowance for Doubtful Debts Date | | Details | | Dr | Date | | Details | | Cr | | | | | 30 June | | D Debts expense | | 200 | | | | | | | | | [/table] [table] Doubtful Debts expense Date | | Details | | Dr | Date | | Details | | Cr June 30 | | Allow for D Debts | | 200 | | | | | | | | | | | | | | [/table] Selected transactions for First Quality Designs, an interior decorator, in its second month of business, July are as follows: [table] 1 | | Invoiced customers $9,034 for services performed. 2. | | Received $4,000 cash from customers invoiced [/table] Additional Information Bad Debts to be written off written off $248 Allowance for Doubtful Debts to be 5% of Accounts Receivable Required Enter the transactions and the additional information for the month of July 2023. Show the (a) Ledger (b) Income statement extract (c) Balance sheet extract Do not include "$" or "," in your amounts The entries must be entered in the order they appear in the question [table] Accounts Receivable Date | | Details | | Dr | Date | | Details | | Cr July 1 | | Balance | | 1,214 | Answer 1 Question 3 no entry31/71/8 | | Answer 2 Question 3 CapitalBalanceLoanBankAllow D DebtsA/c PayableA/c ReceivableService Fees RevenueWagesDrawingsSupplies on handno entryD Debts expenseSupplies expense | | Answer 3 Question 3 Answer 4 Question 3 31/7no entry1/8 | | Answer 5 Question 3 A/c PayableA/c ReceivableD Debts expenseBankAllow D DebtsSupplies expenseBalanceLoanno entryDrawingsCapitalService Fees RevenueSupplies on handWages | | Answer 6 Question 3 | Answer 7 Question 3 1/8no entry31/7 | | Answer 8 Question 3 A/c Receivableno entryWagesBankA/c PayableAllow D DebtsDrawingsLoanService Fees RevenueSupplies expenseD Debts expenseCapitalBalanceSupplies on hand | | Answer 9 Question 3 | | | | | Answer 10 Question 3 no entry31/71/8 | | Balance | | Answer 11 Question 3 | | | | Answer 12 Question 3 | | | | | Answer 13 Question 3 Answer 14 Question 3 1/831/7no entry | | Balance | | Answer 15 Question 3 | | | | | | | | | | | | | | [/table] [table] Allowance for Doubtful Debts Date | | Details | | Dr | Date | | Details | | Cr Answer 16 Question 3 31/71/8no entry | | Answer 17 Question 3 A/c Receivableno entryDrawingsLoanA/c PayableD Debts expenseBankAllow D DebtsSupplies expenseBalanceService Fees RevenueWagesCapitalSupplies on hand | | Answer 18 Question 3 | 1 July | | Balance | | 200 Answer 19 Question 3 no entry1/831/7 | | Balance | | Answer 20 Question 3 | Answer 21 Question 3 1/8no entry31/7 | | Answer 22 Question 3 LoanBalanceA/c PayableService Fees RevenueSupplies on handBankDrawingsWagesAllow D Debtsno entryA/c ReceivableSupplies expenseCapitalD Debts expense | | Answer 23 Question 3 | | | | Answer 24 Question 3 | | | | | Answer 25 Question 3 | | | | | Answer 26 Question 3 1/831/7no entry | | Balance | | Answer 27 Question 3 | | | | | | | | | [/table] [table] Doubtful Debts expense Date | | Details | | Dr | Date | | Details | | Cr Answer 28 Question 3 1/8no entry31/7 | | Answer 29 Question 3 LoanA/c ReceivableService Fees RevenueSupplies expenseWagesD Debts expenseno entryBankAllow D DebtsBalanceSupplies on handA/c PayableDrawingsCapital | | Answer 30 Question 3 | | | | | | | | | | | | | | [/table] Prepare the Income statement extract for the month ended 31 July 2023 Do not include "$" or "," in your amounts Whole amounts no decimals are required The entries must be entered in the order they appear in the question [table] First Quality Designs Income Statement Extract for the month ended 31 July 2023 Income | | | $ Answer 31 Question 3 WagesA/c ReceivableCapitalA/c PayableService Fees RevenueLoanD Debts expenseBalanceSupplies on handDrawingsSupplies expenseBankAllow D Debtsno entry | | | Answer 32 Question 3 Less Expenses | | | Answer 33 Question 3 CapitalLoanno entryService Fees RevenueBankD Debts expenseDrawingsSupplies expenseBalanceSupplies on handA/c PayableAllow D DebtsA/c ReceivableWages | | | Answer 34 Question 3 | | | [/table] Prepare the Balance Sheet extract as at 31 July 2023 Do not include "$" or "," in your amounts Whole amounts no decimals are required The entries must be entered in the order they appear in the question [table] First Quality Designs Balance Sheet Extract as at 31 July 2023 Assets | | | $ Answer 35 Question 3 no entryNon-current assetsCurrent assets | | | Answer 36 Question 3 Bankno entrySupplies on handAccounts receivablePrepaid AdvertisingEquipmentAllow D DebtsAccumulated depreciationDepreciation expense | | | Answer 37 Question 3 Less Answer 38 Question 3 Prepaid AdvertisingAccounts receivableAccumulated depreciationno entryBankAllow D DebtsDepreciation expenseSupplies on handEquipment | | | Answer 39 Question 3 [/table]Check Question 3

In a consumer society, many adults channel creativity into buying things

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!