Questions

ECON3107-Economics of Finance - T2/2025

Multiple fill-in-the-blank

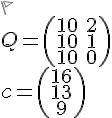

Question textThe following information refers to parts 1-2. It contains drop-down multiple choice and numerical questions. There are two periods (0 and 1). There are three states and two securities, a bond and a stock, with the associated payments matrix The bond costs 9 units and the stock costs 1 unit. Suppose the desired payoff c in the period 1 is Note: the question does not require complex computations. 1) To construct the minimum cost portfolio Answer 1 Question 9[select: , buy 1 bond and buy 3 stocks, buy 1 bond and sell 2 stocks, sell 2 bonds and buy 1 stock, sell 2 bonds and sell 2 stocks, sell 1 bond and sell 1 stock] 2) Compute the price of this minimum cost portfolio: Answer 2 Question 9[input]

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

We start by listing the available options for the first part and noting their upfront costs given the prices provided: the bond costs 9 units and a stock costs 1 unit.

Option 1: buy 1 bond and buy 3 stocks. Cost = 1 bond × 9 + 3 stocks × 1 = 9 + 3 = 12 units. This is a relatively high cost compared with the other options, so it’s unlikely to be the minimum-cost choice unless it provides a strictly required payoff that other options cannot achieve.

Option 2: buy 1 bond and sell 2 stocks. Cost = 1 bond × 9 + (−2 stocks) × 1 = 9 − 2 = 7 units. This reduces cost compared to Option 1 by 5 units, and it is the first candidate for the minimum-cost portfolio since it uses a bond (costly) but offsets part of that cost by shorting stocks.

Option 3: sell 2 bonds and buy 1 stock. Cost = (−2 bonds) × 9 + 1 stock × 1 = −18 + 1 = −17 units. This would......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

For a 5-factor asset pricing model, the following table represents the factor returns and the factor loadings (betas) for a company. Calculate the expected excess return (assume all returns are excess, includes the Risk-Free rate) for the company (answer in percent so 6.1% is 6.1). Factor 1 Factor 2 Factor 3 Factor 4 Factor 5 Factor Return in % 3.9 3.5 0.3 0 4.7 Factor Beta or Loading -1.6 -1.3 -0.3 -1.2 0

Which statement(s) below about CAPM versus multiple-factor APT is/are correct? I. CAPM could be viewed as a special one-factor APT II. APT provides guidance about the sources of risks III. APT does not specify the number of factors IV. APT provides guidance about the magnitude of factor risk premium in equilibrium

For a five factor asset pricing model, the following table represents the factor returns and the factor loadings (betas) for a company. Calculate the expected return for the company (answer in percent so 6.1% is 6.1). Factor 1 Factor 2 Factor 3 Factor 4 Factor 5 Factor Return in % 0.8 -1.4 -2.5 4.8 -2.9 Factor Beta or Loading -1.9 -1.3 -0.6 0 1.3

Using the Fama-French model, a firm has a Beta of HML of -0.5, Beta of SMB of -1.4, and Beta on the Market of 1.2. If the expected market risk premium is 7%, the HML return -2.2%, the risk-free rate is 3.3%, and SMB return 1.6%, what is the expected return of the firm? (Answer in % so 6.1% is 6.1 and to one decimal place).

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!