Questions

FINS5530-Financial Institution Mgmt - T3 2025

Single choice

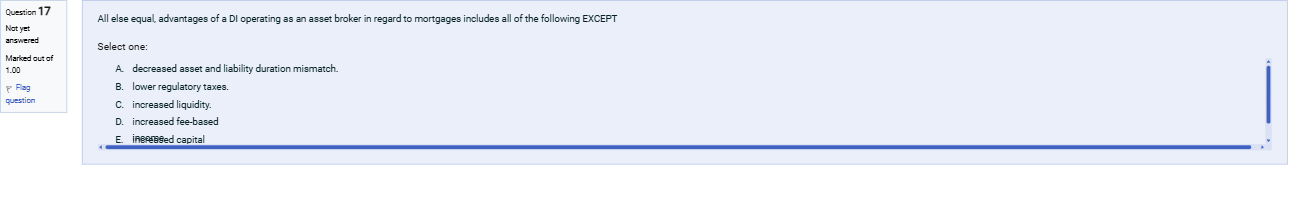

All else equal, advantages of a DI operating as an asset broker in regard to mortgages includes all of the following EXCEPT

Options

A.A. decreased asset and liability duration mismatch.

B.B. lower regulatory taxes.

C.C. increased liquidity.

D.D. increased fee-based income.

E.E. increased capital requirements.

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

To tackle this question, we must evaluate which items represent advantages of a DI (depository institution) operating as an asset broker in mortgage activities, and identify the one that does not.

A. Decreased asset and liability duration mismatch. Thi......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Part 1"Bank managers should always seek the highest return possible on their assets." Is this statement true, false, or uncertain? A. True. The highest return possible on assets will guarantee the highest income for the bank. B. True. Seeking the highest return possible will always prevent a bank failure. C. False. A bank must also consider an asset's risk and liquidity when deciding which assets to hold. D. Uncertain. This statement is true only if the bank has more rate-sensitive liabilities than assets.

Balance sheet hedging is: 资产负债表对冲是:

Balance sheet hedging is:

In a consumer society, many adults channel creativity into buying things

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!