Questions

Dashboard Quiz 7: Taxation Planning (Week 7)

Numerical

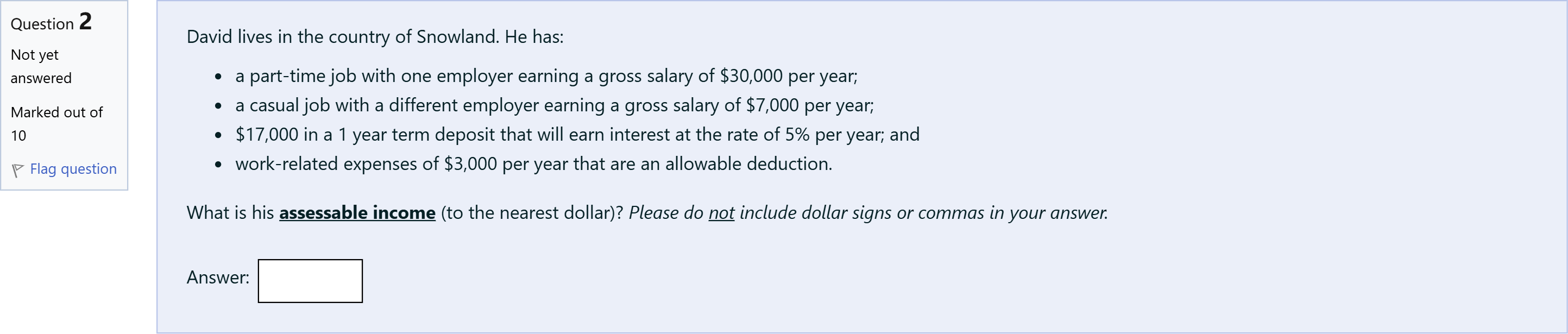

David lives in the country of Snowland. He has: a part-time job with one employer earning a gross salary of $30,000 per year; a casual job with a different employer earning a gross salary of $7,000 per year; $17,000 in a 1 year term deposit that will earn interest at the rate of 5% per year; and work-related expenses of $3,000 per year that are an allowable deduction. What is his assessable income (to the nearest dollar)? Please do not include dollar signs or commas in your answer.

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

Begin by identifying all sources of income and any deductions mentioned.

First, add up the gross incomes: a part-time salary of 30000 and a casual salary of 7000. This gives 30000 + 7000 = 37000.

Next, compute the interest earn......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Julie lives in the country of Snowland. She has: a full-time job earning a gross salary of $40,000 per year; $22,000 in a 1 year term deposit that will earn interest at the rate of 5% per year; and study expenses of $2,000 per year that are an allowable deduction. What is her assessable income (to the nearest dollar)? Please do not include dollar signs or commas in your answer.

David lives in the country of Snowland. He has: a part-time job with one employer earning a gross salary of $26,000 per year; a casual job with a different employer earning a gross salary of $5,000 per year; $14,000 in a 1 year term deposit that will earn interest at the rate of 4% per year; and work-related expenses of $3,000 per year that are an allowable deduction. What is his assessable income (to the nearest dollar)? Please do not include dollar signs or commas in your answer.

During the financial year James, a full-time science teacher received the following amounts: Salary income from working as a teacher $90,000 Winnings from entering an art competition $1,000 Rental income $26,000 An award for teacher of the year $10,000 What is Jame's assessable income

In a consumer society, many adults channel creativity into buying things

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!