Questions

ECON3107-Economics of Finance - T2/2025

Single choice

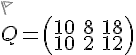

There are two future states and three securities with the associated payments matrix (states by securities) The first security current price is 9, the second security current price is 5 and the third security current price is 14. Are there any arbitrage opportunities? Hint: the calculations do not require matrix inverse.

Options

A.Yes, there are arbitrage opportunities

B.The market is incomplete, and therefore it is not possible to answer this question

C.No, all securities are fairly priced and there are no arbitrage opportunities

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

First, restating the setup in my own words: there are two future states and three traded securities. The current prices are given as P1 = 9, P2 = 5, and P3 = 14. The payments matrix (states by securities) is mentioned but not displayed in the prompt, and the question asks whether arbitrage opportunities exist.

Key point to consider: arbitrage in a finite-state, finite-asset setting typically hinges on whether there exists a portfolio weights vector w such that the portfolio’s payoffs in all states are nonnegative and at least one state has a strictly positive payoff, while the initial cost is nonpositive (or negative). Equivalently, after discounting by state prices or using payoff vectors, arbitrage would show up if the current price vector lies outside the ......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

In a consumer society, many adults channel creativity into buying things

Economic stress and unpredictable times have resulted in a booming industry for self-help products

People born without creativity never can develop it

A product has a selling price of $20, a contribution margin ratio of 40% and fixed cost of $120,000. To make a profit of $30,000. The number of units that must be sold is: Type the number without $ and a comma. Eg: 20000

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!