Questions

MUF0141 Fund. Mathematics Unit 1 - Semester 2, 2025

Single choice

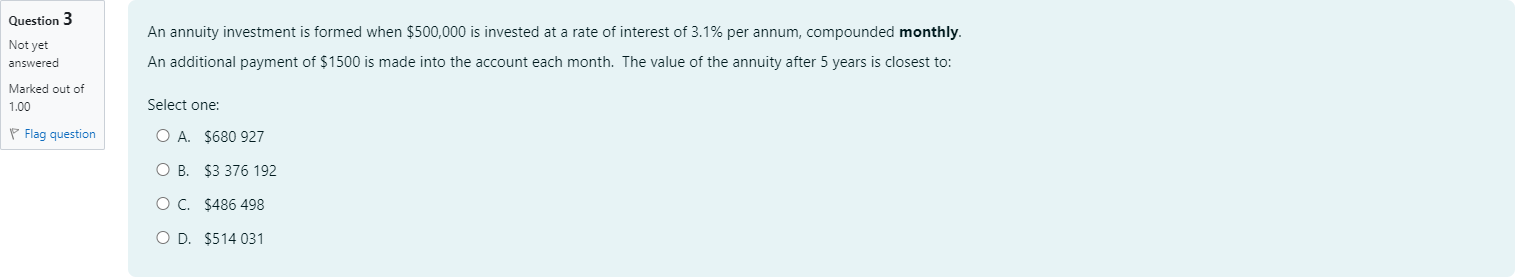

An annuity investment is formed when $500,000 is invested at a rate of interest of 3.1% per annum, compounded monthly.An additional payment of $1500 is made into the account each month. The value of the annuity after 5 years is closest to:

Options

A.A. $680 927

B.B. $3 376 192

C.C. $486 498

D.D. $514 031

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

We start by identifying the two components that contribute to the future value: the initial lump-sum of 500,000 growing at the monthly compounded rate, and the series of monthly payments of 1,500.

First, compute the monthly interest rate: i = 3.1% per year compounded monthly -> i = 0.031 / 12 ≈ 0.0025833. The number of months is......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Which type of annuity has payments that occur at the beginning of the period?

Which of the following best describes the difference between an annuity due and an ordinary annuity?

Which of the following statements is correct?

(4 marks, difficulty level: Easy) Suppose that you invest $28,000 in an account paying 8% interest. You plan to withdraw $2300 at the end of each year for 20 years. How much money will be left in the account after 20 years?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!