Questions

FINS5530-Financial Institution Mgmt - T3 2025

Single choice

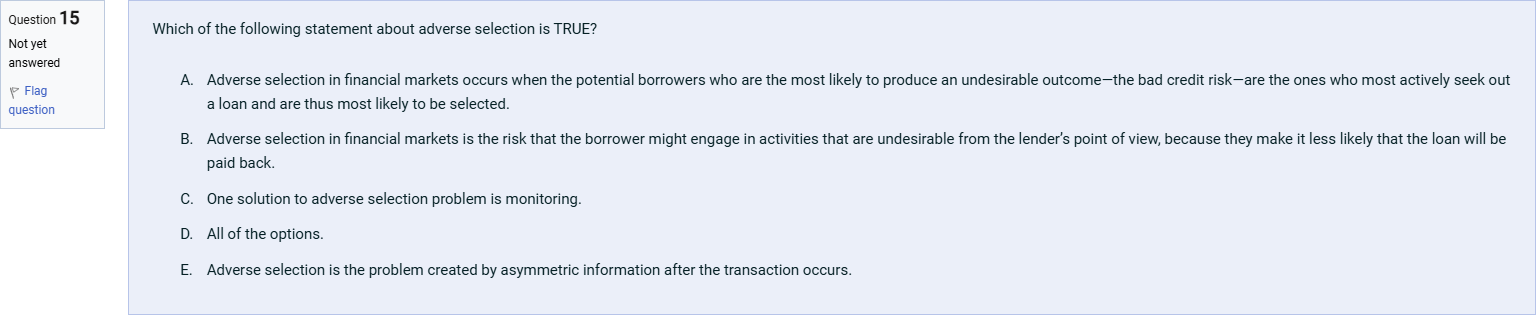

Which of the following statement about adverse selection is TRUE?

Options

A.A. Adverse selection in financial markets occurs when the potential borrowers who are the most likely to produce an undesirable outcome—the bad credit risk—are the ones who most actively seek out a loan and are thus most likely to be selected.

B.B. Adverse selection in financial markets is the risk that the borrower might engage in activities that are undesirable from the lender’s point of view, because they make it less likely that the loan will be paid back.

C.C. One solution to adverse selection problem is monitoring.

D.D. All of the options.

E.E. Adverse selection is the problem created by asymmetric information after the transaction occurs.

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

Question restatement: Which of the following statement about adverse selection is TRUE?

Option A: 'Adverse selection in financial markets occurs when the potential borrowers who are the most likely to produce an undesirable outcome—the bad credit risk—are the ones who most actively seek out a loan and are thus most likely to be selected.'

- This option captures the core idea of adverse selection: those at higher risk are more likely to apply for credit, hence the pool of borrowers offered loans becomes skewed toward bad credit risk. It aligns wit......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

What theoretical problem does asymmetric information create in loan sales?

Suppose a dealership’s has a fraction x of good cars and 1 - x of bad cars. Your willingness to pay is $10,000 for a good car and $4,000 for a bad car. You cannot tell whether a given car is good or bad, but you know the value of x. The dealership requires at least $6,000 to sell you a good car. If you offer the expected value of a randomly chosen car (based on x), for what values of x will the dealership be willing to sell you a good car? The value of x is ____ % (enter 20, not 0.2). Also round you answers to nearest 2 decimals (example: 20.333 = 20.33 and 20.335 = 20.34)

Question29 There is adverse selection into credit when the lender cannot screen good borrowers from bad due to lack of information True False ResetMaximum marks: 1 Flag question undefined

Part 1Because of the adverse selection problem LOADING... :Part 2 A. lenders may refuse loans to individuals with high net worth because of their greater proclivity to 'skip town' B. bad credit risks with a willingness to pay higher interest rates will be the majority seeking loans C. lenders will write debt contracts that restrict certain activities of borrowers D. good credit risks are more likely to seek loans, causing lenders to make a disproportionate number of loans to good credit risks

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!