Questions

MUF0022 Accounting Unit 2 - Semester 2, 2025 Quiz: BDA: Revenues

Single choice

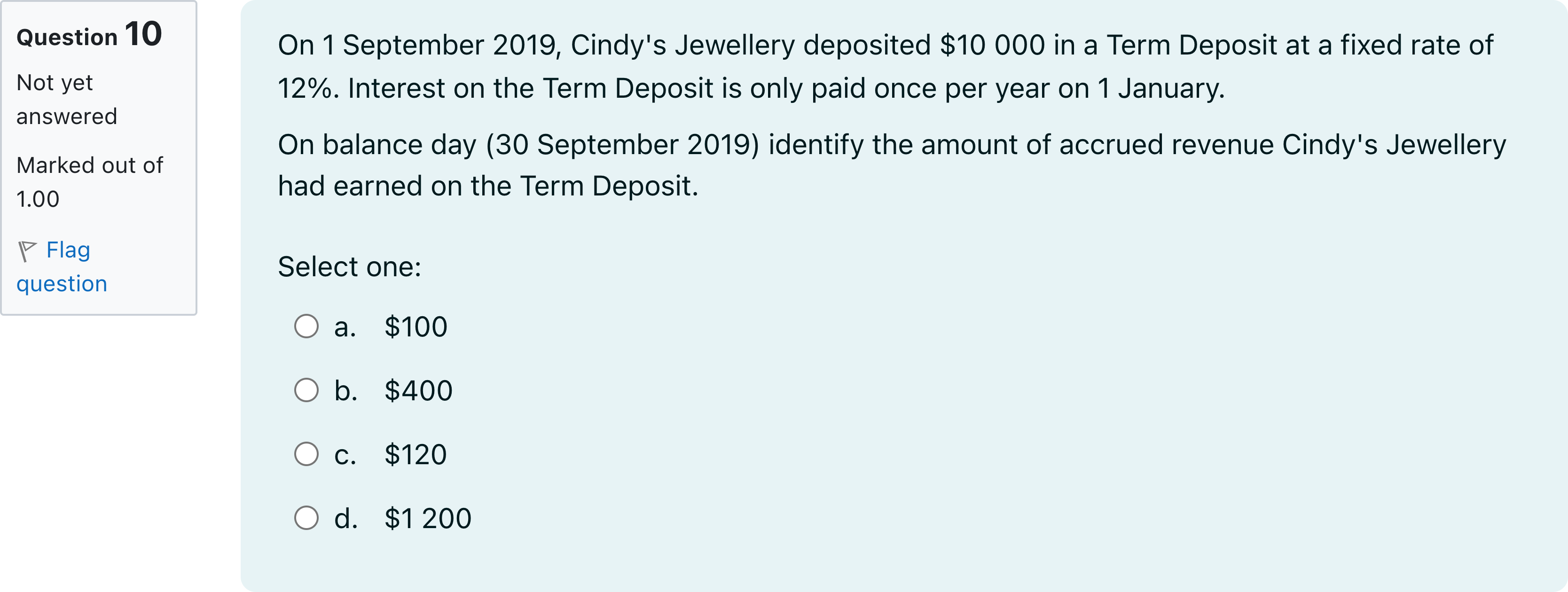

On 1 September 2019, Cindy's Jewellery deposited $10 000 in a Term Deposit at a fixed rate of 12%. Interest on the Term Deposit is only paid once per year on 1 January. On balance day (30 September 2019) identify the amount of accrued revenue Cindy's Jewellery had earned on the Term Deposit.

Options

A.a. $100

B.b. $400

C.c. $120

D.d. $1 200

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

We start by restating the scenario to ensure we’re applying the right timing.

- The term deposit is $10,000 at an annual fixed rate of 12%.

- Interest is paid once per year on 1 January, so on balance day 30 September 2019 we need the accrued interest from Sep 1 to Sep 30, 2019, which is 30 days of the year.

Now evaluate each option:

Option a: $100

- This represents 12% annual interest pro-rated for 30 days using a 360-day year, since 10,000 × 12% × (30/360)......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Which of the following transactions that impact current liabilities has a corresponding entry on the income statement?

A Term Deposit of $7 200 was taken out on 1 July 2018. Interest is earned at 5% per annum. Interest is payable on 30 September and 30 March each year. What amount of Interest Revenue would be accrued on 30 June 2019?

Q8 Kekich & Associates borrowed $6,000 on 1 April 20X2 at 8% interest with both principal and interest due on March 31, 20X3. Which of the following journal entries should the firm use to record the interest incurred by 30 April 20X2?

Kekich & Associates borrowed $6,000 on 1 April 20X2 at 8% interest with both principal and interest due on 31 March, 20X3. Suppose Kekich & Associates makes adjustment to their accounting accounts at end of each calendar month, which of the following journal entries should the firm use to record the payment of interest on 31 March 20X3?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!