Questions

MCD2160 - T3 - 2025 MCD2160: Mid Test Practice Quiz

Single choice

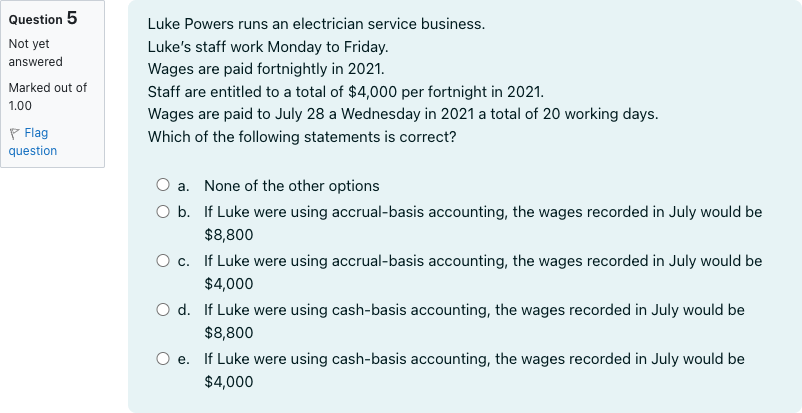

Luke Powers runs an electrician service business. Luke’s staff work Monday to Friday. Wages are paid fortnightly in 2021. Staff are entitled to a total of $4,000 per fortnight in 2021. Wages are paid to July 28 a Wednesday in 2021 a total of 20 working days. Which of the following statements is correct?

Options

A.a. None of the other options

B.b. If Luke were using accrual-basis accounting, the wages recorded in July would be $8,800

C.c. If Luke were using accrual-basis accounting, the wages recorded in July would be $4,000

D.d. If Luke were using cash-basis accounting, the wages recorded in July would be $8,800

E.e. If Luke were using cash-basis accounting, the wages recorded in July would be $4,000

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

We start by restating what the scenario provides and what is being asked. Luke Powers’ staff are paid fortnightly, with a total entitlement of $4,000 per fortnight in 2021. Wages are paid on July 28, 2021 (a Wednesday) and July has a total of 20 working days for the period in question. The question asks which statement about the correct accounting treatment or amounts is true, under accrual-basis versus cash-basis accounting.

Option a: 'None of the other options'. To evaluate whether this could be true, determine the amounts that should be recorded under accrual and cash bases for July, and compare them to the figures given in the other options.

Option......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

Linh Do Ltd sells cars and pays each salesperson a commission of $800 for each car sold. During the month of December, a salesperson, Tom, sold 3 new cars. Linh Do Ltd pays commissions on the 5th of each month following the sale. Tom operates on a cash basis; Linh Do Ltd operates on the accrual basis. Which of the following statements is true?

If accounts payable have increased during a period,

In a consumer society, many adults channel creativity into buying things

Economic stress and unpredictable times have resulted in a booming industry for self-help products

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!