Questions

MCD2150 - T3 - 2025 Week 9 Workshop 2 Quiz

Multiple fill-in-the-blank

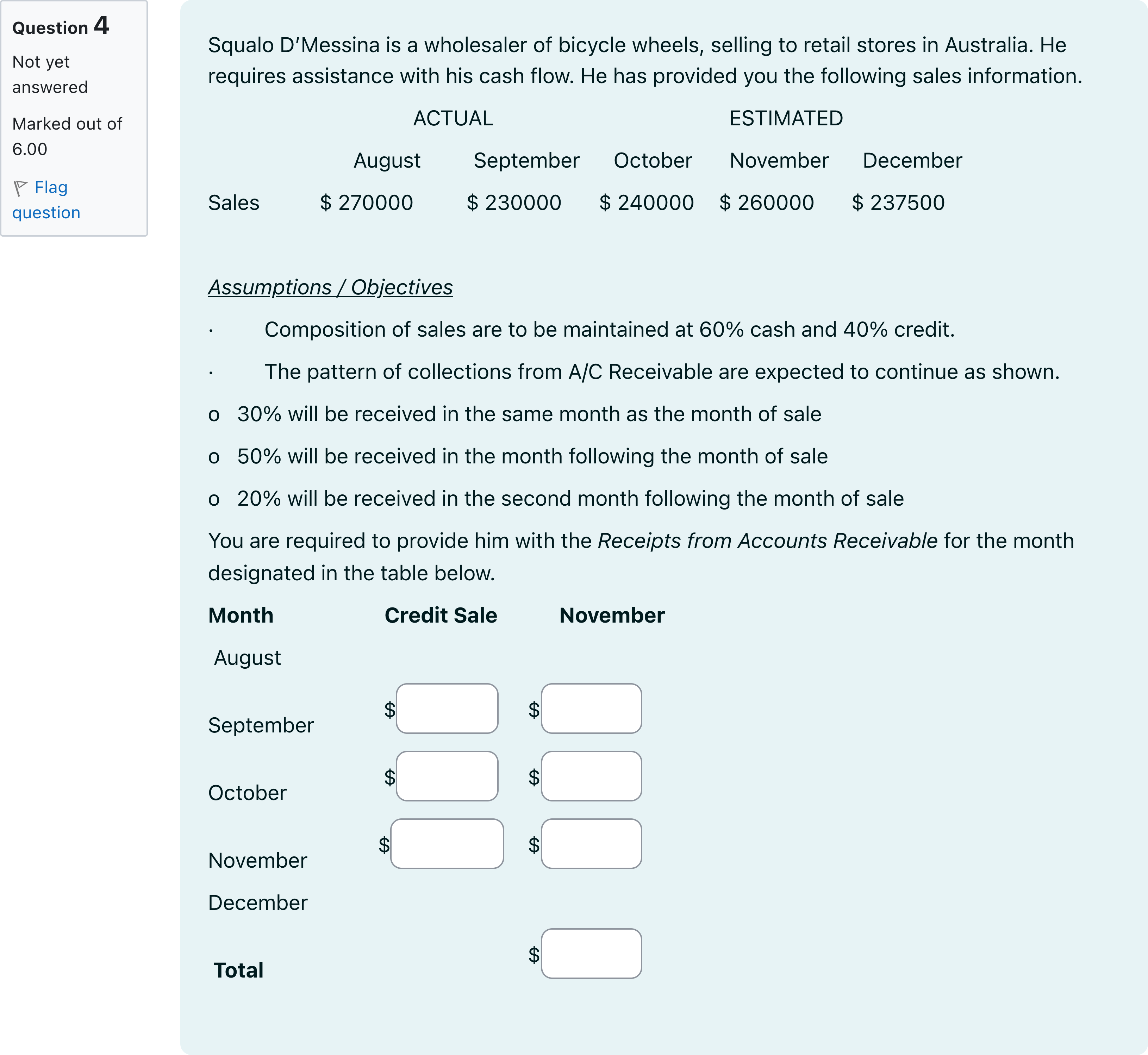

Question textSqualo D’Messina is a wholesaler of bicycle wheels, selling to retail stores in Australia. He requires assistance with his cash flow. He has provided you the following sales information. [table] | ACTUAL | ESTIMATED | August | September | October | November | December Sales | $ 270000 | $ 230000 | $ 240000 | $ 260000 | $ 237500 [/table] Assumptions / Objectives · Composition of sales are to be maintained at 60% cash and 40% credit. · The pattern of collections from A/C Receivable are expected to continue as shown. o 30% will be received in the same month as the month of sale o 50% will be received in the month following the month of sale o 20% will be received in the second month following the month of sale You are required to provide him with the Receipts from Accounts Receivable for the month designated in the table below.[table] Month | Credit Sale | November August | | September | $Answer 1 Question 4 | $Answer 2 Question 4 October | $Answer 3 Question 4 | $Answer 4 Question 4 November | $Answer 5 Question 4 | $Answer 6 Question 4 December | | Total | | $Answer 7 Question 4 [/table]

View Explanation

Verified Answer

Please login to view

Step-by-Step Analysis

We are given a cash flow question involving receipts from accounts receivable with a 60% cash / 40% credit mix and a specific pattern of collections:

- 30% of credit sales are collected in the same month as the sale

- 50% are collected in the month following the sale

- 20% are collected in the second month following the sale

We need to prepare the receipts from receivables for the months listed (August through December) using the sales data provided and the collection pattern.

Step 1: Determine monthly credit sales from the given sales values

- The problem states the composition of sales is 60% cash and 40% credit.

- Credit sales for each month are therefore 40% of the total sales for that month.

- August: 40% of 270,000 = 108,000 in credit sales

- September: 40% of 230,000 = 92,000 in credit sales

- October: 40% of 240,000 = 96,000 in credit sales

- November: 40% of 260,000 = 104,000 in credit sales

- December: 40% of 237,500 = 95,000 in credit sales

Note: We are focusing on the......Login to view full explanationLog in for full answers

We've collected over 50,000 authentic exam questions and detailed explanations from around the globe. Log in now and get instant access to the answers!

Similar Questions

RAIN OR SHINE- Part 5 of 17 Do not use commas, symbols like $ or %, or text such as million, in your answers. To answer the items in the cash flow statements, fill in the blanks with the corresponding cash flows for the reconciliation items listed below. If the reconciliation item needs to be added to net income fill with a positive number. For example, if an item of 100 needs to be added it would be 100. If the reconciliation item needs to be subtracted from net income fill with a negative number. For example, if an item of 100 needs to be subtracted it would be -100. If no adjustment is needed for the particular item, fill with zero. Adjustments to Reconcile Net Income Write the amount of change in Accounts Receivables:

Assume each month has 30 days and a company has a 30-day days of receivables. During the third calendar quarter of the year, that company will collect payment for the sales it made during which of the following months?

Maya’s Dive Shop has an days of receivables of 36 days. The estimated quarterly sales for this year, starting with the first quarter, are $6,800, $7,100, $8,200, and $6,400, respectively. What is the accounts receivable balance at the beginning of the third quarter? Assume a year has 360 days.

Boulder Company had a $75,000 beginning balance in Accounts Receivable and a $3,000 beginning balance in the Allowance for Uncollectible Accounts. During the year, credit sales were $300,000 and customers’ accounts collected were $295,000. Also, $2,000 in worthless accounts were written off. What was the net amount of receivables included in the current assets at the end of the year before any provision was made for uncollectible accounts?

More Practical Tools for Students Powered by AI Study Helper

Making Your Study Simpler

Join us and instantly unlock extensive past papers & exclusive solutions to get a head start on your studies!